Payroll Taxes Will Survive The Executive Order

I am, at heart, a tax guy. So when the talking heads start fighting over payroll taxes, I get excited.

This is a bit of a departure from my usual fare, but I’ll get to applying it to the Indiepreneurs of the world towards the end. So stick around.

Payroll Taxes – A Brief History

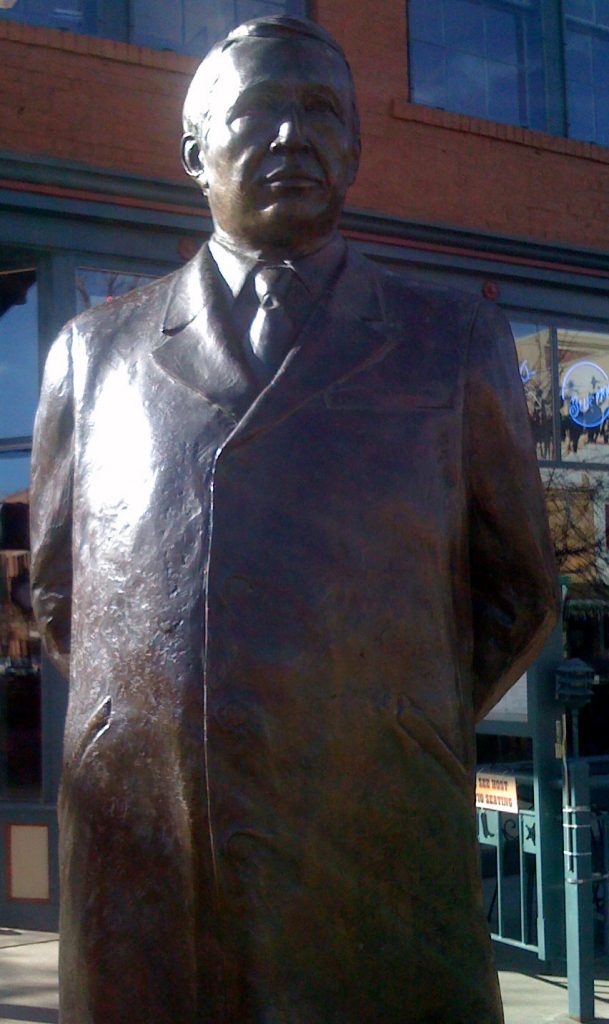

Milton Friedman was a prominent US Classical Liberal economist. One of his most repeated quotes is that “nothing is so permanent as a temporary government program.”

Many attribute his feelings on “temporary government programs” to the creation of the Payroll Tax system.

Without going into too much detail, Payroll Taxes are the taxes that (for employees, at least) are pulled right out of your paycheck without you ever seeing it. They were developed during World War II as an easy easy way for the government to get quick money rather than waiting for individuals to remit their taxes.

They were intended as a temporary program. And Milton Friedman was one of the people spearheading it’s design. Hence the quote.

Since America is full of Americans, some people fought this tax treatment. They wanted their employees to feel the pain of their taxes.

One story that has stuck with me was when the Adolph Coors family protested by giving employees 2 months of full pay, then in the third month pulled out all three month’s worth of taxes. This plan was shortly abandoned.

The Debate Today

I bring this all up mostly because I find it interesting. But also because Donald Trump just signed an Executive Order to temporarily halt collecting payroll taxes during the pandemic.

But wait, there’s more! He claims he’ll forgive those taxes if he’s re-elected, getting rid of payroll taxes altogether.

Sounds like Adolph Coors would approve! But for the living, most who have the power to make this kind of change have greeted it with an eye roll.

Millions are out of jobs, and Medicare and Social Security–the two programs funded by payroll taxes–are on a crash course to run out of money, maybe as early as 2022 for Medicare.

And so reducing taxes on those still fortunate enough to have jobs and further putting Medicare and Social Security into crisis in the hopes that the extra cash will give the economy enough of a boost to get everyone working again AND make up for a nearly $27 trillion dollar deficit seems a little misguided.

If I were a betting man, I’d put money on Milton Friedman being wrong here. This is one temporary government program that’s unlikely to last.

DEFERRAL, not Exclusion

Now let’s wrap this around to the practical issues. The Executive Order DEFERS the collection of payroll taxes.

So from September 1, 2020, through December 31, 2020, employees who have bi-weekly pay less than $4,000 on a pretax basis won’t have any payroll taxes withheld.

And then, on January 1, 2021, those taxes will come due.

For someone on the top of that pay scale, that means $4,000/pay period x 8 pay periods x 7.63% tax rate = $2,441.60 taxes pulled out of that first pay check.

Wait a second…I’m pretty sure I’ve heard this plan before…

Yes, the Executive Order does beg the Secretary of the Treasury to find a way to eliminate that tax. But no matter which way the election goes, chances are the Treasury won’t pull that rabbit out of the hat.

The Moral

Watch your payroll taxes, folks. If you discover that your employer isn’t taking out the full amount, make sure you put the difference into a safe place. That money is most likely going to go to the IRS, and if you don’t set it aside, it’s gonna be an extra grim January.

Photo by MissSomething via Flickr