Top 5 Budget Planner Software

Using a budget planner is like washing your underwear. Yeah, you really need to do it. It’s super obvious when you don’t. But you probably won’t enjoy it.

Over the years, I’ve tweaked my budgeting system to be ALMOST exactly how I like it. I use an Excel sheet in OneDrive. The price is right, and I’ve taught it some cool tricks. Like automatically calculating my income tax liability so I can update my paycheck withholding.

My budget planner has two main drawbacks, though. It’s hard to update on my phone, so I only do it about once a week. And, more importantly, my wife hates it.

So I decided to do some internet sleuthing to see how the pre-made budget planner world is looking these days. While looking, I was looking at the following criteria:

- Easy mobile access

- Easy mobile data entry

- At least somewhat replaces my cool Excel tricks*

- Easy enough to use that my wife will buy onto it

I have to say…I’m a bit disappointed with the results.

So while I usually look at things to make your business run better, let’s dive into software to make your personal finances work better.

*I’m well aware none of them are going to do Tax Planning, but if I can get my data out into my Excel easily, I’m willing to give it a try.

Mint

Let’s start with the budgeting software so many reviewers seem to love: Mint.

I hate Mint.

I’ve tried to use it for literally years, and no matter how hard I try, I just can’t get it to work for me.

But maybe it’ll work for you.

The Good

Let’s look at why people like it, and why I’ve tried it again and again, desperately begging it to finally fit what I want it to do.

Mint links up to all your accounts, even your investment accounts, giving you an automatic high level look at your financial situation. It automatically takes individual transactions from your accounts and tries to place them. It has some nice budgeting tools and some pretty graphs. The mobile access is absolutely top notch.

It’s trying to be an all-in-one financial picture solution.

And it’s hard to beat the price of looking at some fairly unobtrusive ads. Well, except the insistence on getting your credit checked…

It also has best system of notifying you when a bill is coming up. It’s one of the things that I genuinely liked. And you can actually check off when you’ve paid a bill. It’s both genius and so obvious that none of the others I tried bothered to implement something similar.

Even as I’m writing this, I’m thinking, “but it might work for us!“

Then I splash some cold water on my face.

The Bad

Mint is not a budget planner. It’s an expense aggregator for those who don’t like to enter numbers.

I mean, yeah, there’s some budgeting tools, but nothing holds you accountable. There’s no easy way to move funds from place to place if you overspend in one category. And heaven forbid you want to change that recurring expense for a single month.

Even worse, I never felt I could trust the amounts coming through.

One of my cards would easily take over a week to post into Mint. Not good if you’re trying to decide if you can afford the Premium Edition versus the regular.

Yes, you CAN manually enter expenses into Mint. Which then promptly gets double counted when the card finally syncs.

See, manual entries are for those weirdos who want to use cash to buy stuff. Not for those who have janky credit card connections.

Then there’s the categories. I meticulously set up categories just the way I wanted it. Which the automatic system promptly ignored. I ended up spending longer hunting down and reclassifying things than I would have manually entering expenses in Excel.

Oh, and I’ve been told I’m “wrong” to do this, but I don’t like that it pulls my net paycheck rather than allowing me to put in my gross. Apples to apples comparison is important for me, though. And I need that gross number for my tax estimate sheet.

Summary

Mint is a huge step up from nothing. But it’s a reactive form of financial management, which I have a hard time recommending.

- Cost: Free with Ads

- Summary of Features: Automatically compiles transactions from almost all financial institutions (in it’s own dang time)

- Data Entry: Mostly automatic, though some limited entry features designed to capture cash transitions

- Mobile: Very pretty, located everywhere

- Recommendation Level: It’s better than doing nothing

You Need a Budget

I’ve run into so many people who swear by YNAB, including my brother. Several times I’ve considered using it, but I keep getting hung up on the price.

This thing is not cheap.

The creators justify the cost by having a good, not ad supported program that works on all kinds of systems. It even works on Alexa and Apple Watches (which I haven’t tried, but seem like use would be limited)

YNAB (as the cool kids call it) is our first Zero Based Budget Planner, which means it is designed to make sure every dollar you make does something. They call it “having a job.”

It reminds me of The Richest Man in Babylon, a book my bishop made Amy and I read before we got married. Which is a weird book.

Anyway, my experience with YNAB has been much more limited than with Mint, but I’ve spent quite a while to make sure I had this thing figured out.

The Good

Hey, it’s an actual budget planner, not just a wealth aggregator. Nice.

The program starts with an unobtrusive onboarding process that you’re free to ignore. It gives you some pointers on how to think about a budget, which I can see as being very helpful for those who don’t actively work on Excel budgets in their free time (I know I’m an outlier in this world).

YNAB allows you to either automatically sync to your accounts or to enter in your expenses manually. Best of all, it allows a hybrid approach: enter your expenses manually, and then it’ll attempt to automatically associate what’s on your bank account/credit card to what you’ve entered. That way if you have a slow card you’re not waiting a week to have your account correct.

And you can enter the expenses from your mobile phone. If you allow the YNAB app to access your location, it’ll even try to guess where you are to remove a little bit of data entry.

If there’s a transaction it doesn’t recognize, the app flags it for you, rather than just randomly sticking it in some account. Unlike Mint.

It also has some good long term planning tools that weren’t too hard to figure out.

YNAB also has a very robust community. Every time I got stuck, a really quick Google search told me how to do it.

The Bad

It was pretty easy to find answers when I needed then. But the fact I had to search so much was a little disheartening. YNAB has a little bit of a learning curve to it.

For example, I’m still not sure if it has a bill payment date notification system. I don’t think it does, but I found a guide that kind of may have indicated that it did. If I does, I certainly can’t find how to implement it (email me if you know where it is).

That means I’ll have to track my bill due dates separately. Which is fine, but it’s not comprehensive like my Excel workbook. And it’s definitely not the nice “email reminder and check off” system that Mint has.

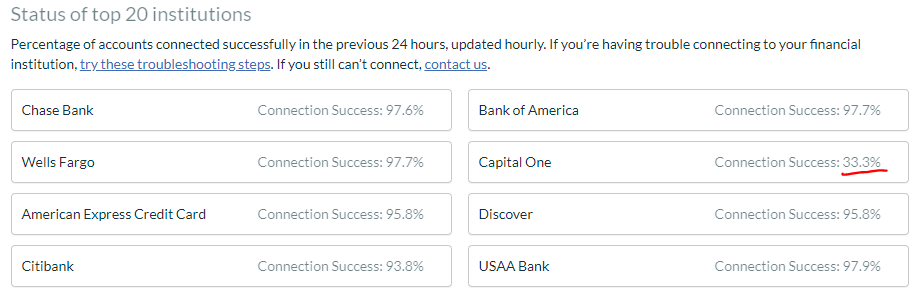

Also, I has serious issues connecting to one of my financial institutions. I went to their support screen and this came up. Want to guess which one I’m trying to connect to:

Mint also has some problems with this card. So did Excel Money (not reviewed). Everydollar (more on that later) did not.

Also, since this is a monthly zeroed budgeting tool, it doesn’t really do a total year shot. I’m a tax accountant, so EVERYTHING is looked at on an annual basis. This is a very different way of thinking for me.

It’s also definitely not as pretty as Mint…

And, last of all, this thing isn’t cheap. $11.99 a month of $84 a year. That can be a lot of swallow.

Summary

You Need A Budget is a robust budget planner with an active community and great features. If you need budgeting discipline, this is definitely the way to go. Unfortunately, all of that comes at a price.

- Cost: 34 day trial (just enough to put in tons of work and either treat it as a sunk time cost or pay the price). Then $11.99/month or $84/year

- Summary Features: Pushes you to really know where you’re money is going

- Data Entry: Amazing combo of automatic and manual

- Mobile: Good app, Android, iOS, and everywhere else

- Recommendation Level: Very high, if you have the money for it

Try out You Need a Budget here

Everydollar

When I was looking on Reddit for new budget planner software, Everydollar came up several times. I hadn’t heard of that, but I’ve definitely heard of the person backing it: Dave Ramsey.

Let’s jump in.

The Good

It’s pretty. And the only ads it has is the big one: upgrade to Ramsey+.

If you’re using the free version, you get a data entry (including on mobile) budgeting tool that will give you a look at your month. It’s really, really bare bones.

Once you upgrade to Ramsey+ (which, surprisingly, isn’t a video streaming service), you get the long term planning tools that Ramsey is known for.

For the actual budgeting tool, the main thing it adds is syncing with your bank accounts. Once it does that, it gives you a nice drag-and-drop feature to put your expenses in the right category, rather than Mint’s autoguess.

If you want any actual budget planner, well, then you have to pony up. Those planners looked nice, but…

The Bad

Argh! The log in page is on ramseysolutions.net, but the app is on everydollar.com!

Why does that matter? Because it messes up with my password management system and set up TWO logins!

Okay, that’s a super minor issue. But I HATE IT!

(Mint also suffers from this problem which still shows up occassionally)

On to more serious issues.

If you pay for Ramsey+, it’ll sync with your financial institution. But there’s no hybrid approach like YNAB, which means your expenses are either out of date or doubled up, which is too bad. For $129 a year, would hope for more.

Weirdly, there’s no bank account break down, either.

What I mean by that is that I can’t just click on my CapitalOne card in EveryDollar and it shows me all the transactions.

I had thought this was a standard feature with all budget tools, but I guess it’s not. That means I can’t review all transactions coming through my CapitalOne card (which DOES sync here, unlike YNAB). This could be a big issue, especially if you’re manually entering everything and have multiple accounts/credit cards. It removes an easy way to double check to make sure you caught everything.

There’s also no bill tracking like Mint has. Certainly not in the free version, and not what I could see in the paid version.

Which brings me to the price. I thought YNAB was expense. But EveryDollar beats it at $129.99 a year.

$129.99 a year is a lot. What you get is the syncing, plus help on bringing your debt down and planning for goals.

Are those extra features worth it? I’ll be honest, I didn’t play with them much, because I wasn’t enamored with how the budgeting worked. Not having an account level detail was pretty much a deal breaker for me. But I can tell you the only way to get real month to month analysis is to pony up for the expensive version.

Summary

- Cost: Free for Basic Features, 30 day trial of Ramsey+, then $12.99/mo (if you go to cancel the free trial) or $129.99/year

- Summary Features: Free bare bones budgeting, Upgrade has some planning tools

- Data Entry: EITHER manual entry or automatic (with +), but no aligning the two

- Mobile: Android and iOS, look nice

- Recommendation Level: If you’re a fan of Ramsey and want to try his budget planner for $129.99 a year, go for it. Everyone else probably wants to look elsewhere

Budgetwise

I’ll be honest, I was a bit disappointed with the commercial budgeting programs (see my list of the ones I DIDN’T try below). And that’s when I was pointed to some beta apps to try out. Budgetwise is my first beta app.

The Good

For an early release, Budgetwise does a bunch of stuff right. It’s really easy to add categories. It actually has due dates for your expenses!

Also, something I learned with Everydollar isn’t standard: it tracks your expenses by individual bank accounts/credit cards. Really, every program should do that. Especially those that are manual data entry.

Which Budgetwise is. I know manual entry is deal breaker for a lot people, but it can be helpful to have a handle on the individual expenses going out.

It’s also really easy to look at multiple months side by side, as it should be.

Basically, this is like Excel on the web, which works for me.

The Bad

It’s definitely in beta.

It’s missing a bunch of features. Like account syncing. Any sort of onboarding. A dedicated button to add an expense (you have to go into your account to add it in).

Oh, and no mobile app. That’s a deal breaker for me right now. Might as well use Excel.

Summary

I decided to keep this in my list of budget planners because it seems like it has potential. It’s in active development right now with a surprisingly active community. I’ll check back in when a mobile app is available.

- Cost: Generous free trial (which you can extend), then Early Access pricing of $3/mo, $24/year, and $99/lifetime

- Summary Features: Like Excel, but online

- Data Entry: Manual

- Mobile: Not yet

- Recommendation Level: For the adventurous who don’t mind being tethered to the computer

Everypocket

And here we are on beta app number two, which is designed to be similar to You Need a Budget.

Everypocket, or EP, as they are trying to be called.

The Good

This is a beta, currently free version of a You Need a Budget clone. Considering how popular YNAB is, you’d think that there would be more budget planners out there to trying to capture that lighting. I mean, it’s not like zero based budgeting is patented.

Everypocket is simple. Each month shows you how much you have, and whether you’ve gone overbudget. It’s really simple to add in new budget categories, which is great.

It also gives a nice 3 month summary. No sort of analytics or charts here, but it’s still nice to have the side by side comparison.

And, like Budgetwise, for better or worse you need to manually enter in all of your expenses.

Oh, and the price is impossible to beat: free! You just have to suffer through the beta.

The Bad

No account break down?! Seriously? I guess this is a thing.

For manual entry, it seems like this would be an absolutely required feature. But I’ve come across two programs that don’t do it here.

Everypocket also lacks some of the future planning advice that YNAB has. I’m guessing they’re planning to add that in later, but it’s definitely a big hole in the programming right now.

Unlike Budgetwise, Everypocket offers a mobile app. The app allows you to enter in your expenses on the go. And that’s it.

Yes, if you’re sitting at Best Buy and trying to decide if you can afford that Sonos speaker, opening up the Everypocket app will provide you zero guidance.

That’s assuming you have Android. If you have iOS, there’s nothing to open.

Summary

So, yeah, still in beta. But I think it’s one to watch, if for no other reason than to finally get an actual YNAB competitor.

- Cost: Currently Free while in Beta

- Summary Features: Like YNAB, but without all the features

- Data Entry: Manual

- Mobile: Android Only, and only offers expense entry

- Recommendation Level: Without account breakouts, it’s hard to do

Give Everypocket a free try here

Other Budget Planner Programs Considered But Not Reviewed

I looked at a whole bunch of budgeting programs before I settled on the five above. Here’s some of the others I looked into:

- Toshl – Too much like Mint.

- Quicken – Like Mint, except they really wants you to use their desktop version. It used to be owned by Intuit, who owns Mint, so that makes sense. Also, Quicken doesn’t offer a trial version, they wanted me to buy it right away then ask for a refund if I didn’t like it. No thanks. I hear it breaks out business income better, though.

- Personal Capital – Budgeting features are more of an afterthought.

- Excel Money – I actually started down this route before realizing how it didn’t solve any of my problems of doing budgeting in Excel. Plus it doesn’t sync with that problem child bank, Capital One.

- Tiller – Isn’t this just automating Excel?

- CountAbout – Again like Quicken and Mint.

[…] Separate Bank Account: Ideally, set up a separate business bank account. Then pull out money to your personal account when you want to spend it on yourself (kind of like a salary). […]

[…] income and expenses. Estimate high on costs and low on revenue, and maintain a line item budget audit on a quarterly basis. This will help ensure you identify potential financial issues before […]

[…] based budgeting and into an online, mobile app supported program. After reviewing the options (discussed here), I settled on You Need a Budget, or YNAB for short. After using it for around nine months, I […]