6 Things to Consider with your Independent Contractor Taxes

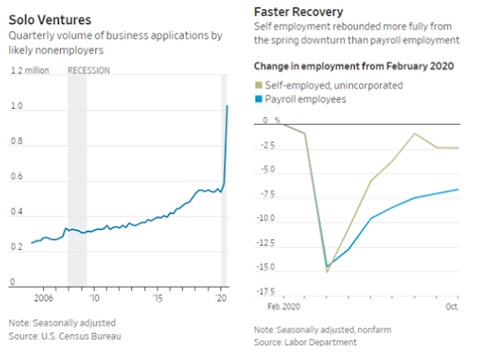

This 2020 pandemic has led to all kinds of weird changes. For example, who had huge rise of independent entrepreneurs and independent contractors on their bingo card (link behind WSJ paywall)? With this unexpected increase, plus the year end looming, I thought now is a great time to review the big things to consider with independent contractor taxes.

Bonus data: I love this chart by University of Maryland economist John Haltiwanger, showing the dramatic rise in independent entrepreneurship:

(I found these charts in an article by Scott Lincicome, which is also behind a paywall)

This increase is fantastic, especially if these new found independent entrepreneurs and independent contractors find success. It’ll have far ranging consequences well beyond the pandemic years.

So for all the new Indiepreneurs in the world, I give you 6 things to consider before you send in that 1040.

(1) Set Aside Self Employment Taxes

The first thing to screw up so many independent contractor taxes is the Self Employment Tax.

What are those?

Woo boy, you’re in for a surprise.

As a regular employee, your employer withholds a significant amount of taxes before dropping money into your bank account. For most people, this will be 7.65% of of your paycheck.

In addition to that, your employer pay another 7.65% on your behalf.

What happens when you don’t have a boss? That FULL 15.3% tax becomes your responsibility.

The actual amount you’ll have to pay is more complicated than a flat 15.3% tax, but that number is a good rule of thumb.

This tax is paid on your 1040, but it is COMPLETELY SEPARATE from your income tax. So even though you are paying 15.3% taxes on your independent contractor income, you’re ALSO going to have to pay income taxes.

It also means that all those standard deductions you’re familiar with will do NOTHING to lower that tax (though we’ll talk about what will in #4)

TAKEAWAY: Set aside AT LEAST 15.3% of your net business income for Self Employment Taxes.

(2) You’re (Most Likely) filing on a Schedule C

Did you start working on your own without analyzing the complexities of business organization and state registration?

Don’t worry, you’re fine (at least for tax purposes).

If that’s the case, when you file your 1040 this year, attach an additional form called the Schedule C.

The important thing to remember here is that if you are trying to do your return by yourself (using TurboTax, etc.), make sure you get the version that includes the Schedule C. It will cost more.

And if you’re paying someone to do your taxes, they will charge you more to handle a Schedule C.

Yes, it sucks. But it is more work for them, so they pass that along.

If you want to get really complicated, you can set up an S Corp.

NOTE: If you are doing this business with a partner, then you’ll be filing an entirely separate Form 1065. It gets complicated. You’ll want to get professional tax (and likely legal) help.

TAKEAWAY: Get ready for more tax filing complexity.

(3) You Don’t Need an EIN, but It’s Helpful

With independent contractor taxes, you are legitimately running a business enterprise.

To help make things easier for those who just want to get up and go, can use your name and Social Security Number instead of setting up a separate business.

Using your name and Social Security Number are fine, but it has some limitations. For one, there are times where you might have to give it out your business number. And you might not want to hand out your SSN too often with all the fraud going around.

For two, you won’t be able to create a cool legal business name for your independent entrepreneur venture.

As an alternative, you can set up a legit separate business entity. This has many benefits, but it does take effort and cost.

- (1) Set up a business with your state.

- (2) Pay your state to set this up. This can be pricy, and likely has to be done annually

- (3) Get an Employer Identification Number, or EIN, from the IRS. This works like a Social Security Number. It’s (thankfully) free.

Again, none of this is necessary to get your independent contractor taxes filed. But it offers legal benefits, and its worth looking into.

TAKEAWAY: You can just run your business as you, but making it a separate entity can be good.

(4) Expenses are Allowed for Your Legitimate Business Expenses

If there’s one thing I’ve learned as a tax accountant, it’s that people love deductions.

There’s some good news here: as an independent entrepreneur, almost all of your legitimate business expenses are deductible.

[NOTE: Since we’re talking the government, there will be exceptions–like meals and entertainment–that have special tax considerations]

This can be really helpful. If you’re driving, buying needed equipment, doing marketing, etc. these kinds of expenses can not only help your business grow, but will lower your business taxable income.

Just don’t go overboard. You shouldn’t buy stuff just for the expense. Even if you’re in the highest tax bracket, spending $1 to get about 40 cents back is dumb. But it’s a good benefit for things you need to buy.

TAKEAWAY: As as business, you have business expenses, which lower your tax bill.

(5) Tax Will be on your Net Business Income

Continuing with the previous point, your independent contractor taxes are based on your NET business income.

Let’s use the personal trainer example that the WSJ used. Let’s say I drive to a client and get paid $60 for an hour of personal training. My taxes would not be on that $60. Instead I would next it with those legitimate business expenses.

For this client, maybe I have $5 in mileage for driving to their house, plus another $3 in supplements I’m letting them sample (I’m making these numbers up here). My net business income for this client would be:

$60 – $5 – $3 = $52.

I’d then base my taxes on that $52 number.

(Obviously I’d be doing this calculation on ALL my business rather than figuring it out client by client, but this is just an example)

TAKEAWAY: Make sure to look for all business expenses to lower your taxes due.

(6) Keep Records!

Of all the things you can do, keeping records is probably the most important.

Honestly, the chance of an IRS audit is extremely low. But this isn’t the kind of game you want to play.

With that, here are a couple words of advice:

- Do it now!: Don’t wait until April 14th to collect all your documents. Scan in and organize receipts as they happen. Log your income as it comes in. This will not only make your life much easier come tax time, it’ll make it much less likely you’ll miss something.

- Digital Records: Digital records work great. No need to keep the physical receipt.

- Separate Bank Account: Ideally, set up a separate business bank account. Then pull out money to your personal account when you want to spend it on yourself (kind of like a salary).

- Track Your Trips: Commuting miles are not deductible, but miles for the rest of your business trips are. If you are visiting a client or visiting a work site, track how many miles it took. No need for odometer readings, but you need a starting point and ending point and number of miles (looked up on Google Maps is fine). These should all be LOGGED and saved somewhere.

- Separate Joint Expenses: If you use the internet for both personal and business purposes, track the full amount and come up with a reasonable allocation between business and pleasure. And keep a record of how you came up with your justification (amount of time, amount of data used, etc.)

[…] My latest: It’s coming to the end of the year. If you or someone you know started up an independent entrepreneurship this year, read these 6 tax tips to keep in mind. […]

[…] I’ve been lacking in my explanations, something that I should probably remedy in it’s own post. So let’s sum it up here: if […]

[…] Misclassifying workers. Anyone who does any work for your business must be classified as either an independent contractor or an employee. Depending on the circumstances, this can sometimes be a difficult distinction, but it’s an incredibly important one. Payroll and withholding rules are different for employees versus contractors. […]