Tax Deductible Travel for the Independent Contractor

At the time of this writing, business travel might not be the best idea due to the COVID-19 fears. But as that starts to calm down, many Independent Contractor Indiepreneurs will be asking again what counts as tax deductible travel.

The easy answer is “most of it, but not all of it.”

What Counts As Deductible Travel

When you’re traveling, the first thing that an Indiepreneur needs to determine is if it’s for a business purpose.

Are you meeting up with a client, whether by plane, train, or automobile? Then your costs are deductible travel expenses.

NOTE: we’ll get into specifics on the automobile part in another post, since they can get complicated.

Do you need to meet your agent in New York? Yep, the travel expense is absolutely deductible, including any hotel room you need. Or if you’re putting on a show in Cincinnati, those travel and hotel expenses will certainly be tax deductible.

That’s the first part of our “easy” answer: if you determine a genuine business purpose, it’s deductible travel.

Travel That Doesn’t Count

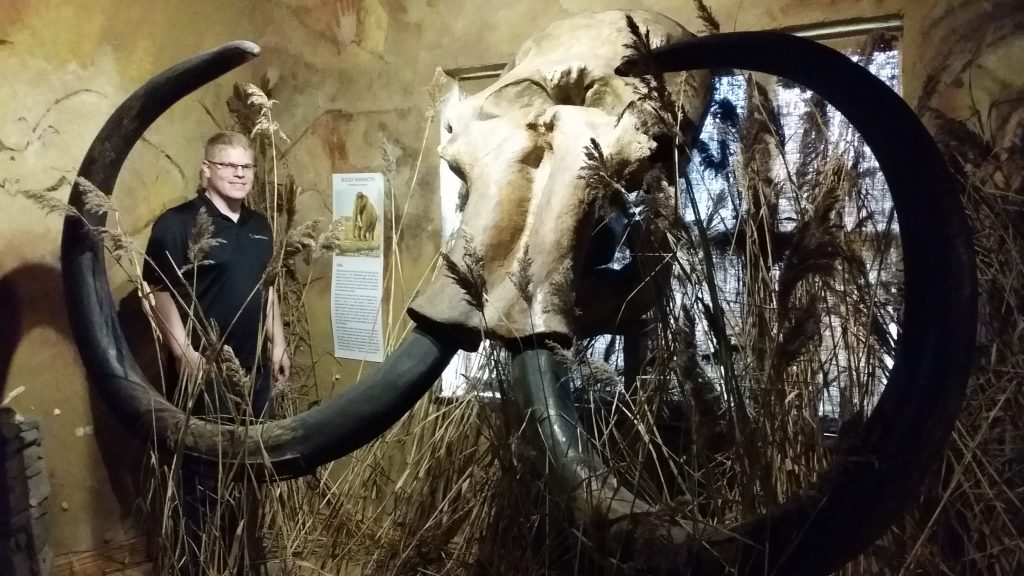

Let’s go through a common scenario: you travel to a place like New York City for a 100% valid business purpose. But while you’re there, you decide to stay a few extra days to go to the Mmuseumm or the Morbid Academy Museum. Or maybe even do something normal! Whatever’s your jam.

How do you account for this personal part of the trip?

To quote the greatest movie that nobody’s seen, “Great news, T. Furrows!” The answer is quite favorable.

The only part of your trip that wouldn’t be considered deductible travel would be the EXTRA costs. Your flight is still deductible, since you have to fly no matter what. Your normal hotel stay is still deductible. If, however, you decide to stay a few extra days for fun, the extra hotel nights would NOT be deductible.

That means as long as you’re fitting in your weird museum fetish in between your business meetings, ALL of your travel expenses will remain deductible.

Your SO is an Additional Cost

If you want to bring your Significant Other on your business trip–AND your SO isn’t an integral part of your business and has a valid business reason to be there–that extra plane ticket would NOT be tax deductible.

However! As long as your SO is sharing your hotel room, that hotel room is still 100% deductible.

The moral of the story is to make your SO an integral part of your business if you want to deduct the plane ticket. Though you should obviously consider non-tax reasons before you make this decision (I have an old manager who would tell you all the divorce reasons why you should be careful here).

Other Considerations

A big part of travel will be meals and entertainment. Those will continue to be deducted under their respective tax rules.

Also, although you may have a valid reason to commute to a place of work (rather than working out of your home like most Indiepreneurs), your commuting expense is NOT tax deductible travel.

Finally, for the author or artist who wants to travel the world for research purposes…be careful. If you are an established creator with a successful business already, you might be able to get away with SOME of this. The courts, however, have ruled against the guy traveling the world taking photos for the book he was planning to put together. They were not persuaded, especially since the “book” had not come out by the time of the court case some 3 years after the deduction was taken.