Setting Up Your LLC and Why You Need One

This pandemic has been a terrible tragedy, and we’ll likely feel the side effects for decades to come. One side effect that we’re running through right now is the so called “Great Resignation,” which even I’ve been caught up in.

Many of those, like me, who have resigned are looking to start out on their own. And many more are trying to start a new side hustle to supplement the 9 to 5.

Maybe you’ve been hearing from your friends or the internet that if you start a new business, you should be setting up an LLC. If you’re not sure what that means, or maybe you are but have no idea how to actually make that work, read on.

So much goes into starting a new business, and getting the legal organization right is a good place to start. An LLC is hardly the only option, but it will be the best option for most people.

What Is an LLC?

Yes, the LLC is a good option for that business or side hustle. Now what the heck is it?

You’ve heard of corporations and partnerships. If you’re a little more savvy in the business world you’ve likely heard of S Corps and C Corps and Limited Partnerships and so on.

These are all different ways to organize your business venture. An LLC is one of them. It’s an acronym for Limited Liability Company, and it’s a relatively new form to legally organize your business. This business type started in 1977 in Wyoming and has since taken the rest of the United States by storm.

The general idea of an LLC is to give you some legal protections when your business screws up (the whole “limited liability” thing) without forcing you into a corporation.

Side note: having a corporation doesn’t make you evil, per se. But it is more complicated to manage.

Translating this out of the legalese, if you have a business, you should have a business legal organization. If you choose to get an LLC, it will help when the lawyers come without making life too complicated in the meantime.

Do I Really Need This?

If you’re just starting your business, or if you’re getting some minor money from your side hustle, or if you’re an independent contractor, all the effort of setting up an LLC might seem overkill. You just want to work.

The good news is that you can do that. You can just start selling your widgets or fixing the cogs or doing whatever it is you do, and there won’t be any G Men showing up at your door to take your business away just because you didn’t create an LLC. And if you’re an independent contractor who gets all your money from one or two people, just going to work without dealing with an LLC might even be the way to go.

But for everyone else, I’ll give you 3 reasons that you will want an LLC:

- Legal Protection

- Separate Bank Account

- Identity Protection

Let’s dig into each of those a bit more.

Legal Protection

A few years ago, I was at this networking event talking to this guy who worked with a lot of Russians. He told me one of those Russians came to him and said, “Oh, I get it now! In America, there is no KGB. Instead, you have lawyer!”

Take from that what you will, but one thing for certain is that we are a country of laws. The more legal protection on your side, the better off you are when the lawyers come calling.

Setting up an LLC gives you some of that legal protection.

The easiest to explain this is to go back to the 2012 presidential election. Remember that? Yeah, me neither. But one thing that comes through the whirlwind of a decade since then was the flak that Mitt Romney got for saying that corporations are people.

Politically, probably a dumb move. Legally, he was absolutely right. Our piles and piles of laws often define corporations and other business organizations as people.

That means when you set up an LLC, you’re basically creating a new person (look at you, playing God). And when this new person screws up, the lawyers have to go after it, not you.

This legal protection is in no way perfect. There’s this thing called “piercing the corporate veil” where the lawyers can still get to you, especially if you do something really, really bad.

In general, though, that LLC gives you an imperfect shield in the crazy legal world.

Separate Bank Account

If you want your business to have a bank account, the bank is going to want to see that it is a real entity. This means creating an LLC and getting an EIN (more on that later).

Sure, you can keep using a personal bank account to run things through. But it’s a much better business practice to keep the money separate. There’s plenty of tax and legal reasons for that, but for now, let’s just leave it at, “Don’t do it!”

Identity Protection

Did you know if a business pays you more than $600 for your work, they are legally required to issue a 1099 to both you and the IRS?

Did you know that if you don’t have a separate EIN (again, more on that later) you will have to give that business your Social Security Number so they can issue you that 1099?

Do you really trust everyone enough to hand out your Social Security Number like that?

If not, you need to create an LLC and get that EIN.

Setting Up The LLC

Hopefully I’ve convinced you that you need this. Now what?

You have to actually set the dang thing up.

This is where things might get a little difficult. See, LLCs are a STATE legal entity. That means each state makes their own rules, including how to get things set up.

As much as I’d like to give everyone a link to where you need to go, the time and effort to put all 50 of those down and make sure they’re constantly updated doesn’t seem like a good use of my time.

Instead, this is what you need to do:

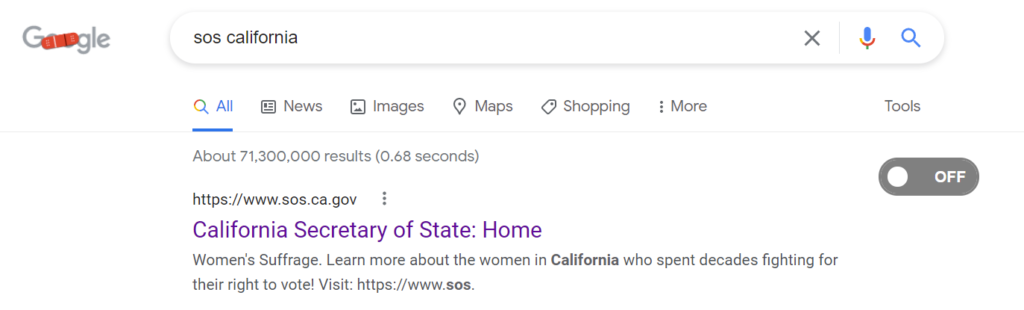

- Open Google (other search engines will probably work, but I haven’t tested it)

- Search up “SOS [your state name]”

- Click on the first option

I’m not telling you to cry out for help. If you search for SOS Maine or SOS Nebraska, the top option is always (at least in my experience) your state’s Secretary of State.

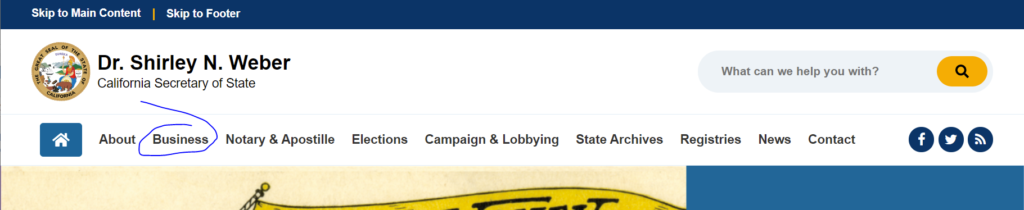

On that page, there should be a “business” option, which should give you instructions on how your state handles LLCs.

Let’s Try It

I live in Colorado, so I know how it’s done here. I decided try it out for my childhood state of California. So I pulled up Google, and here’s what I got

Like I said, the very first one is the California Secretary of State. And what do I find right on the header of the page? A quick link to the business area:

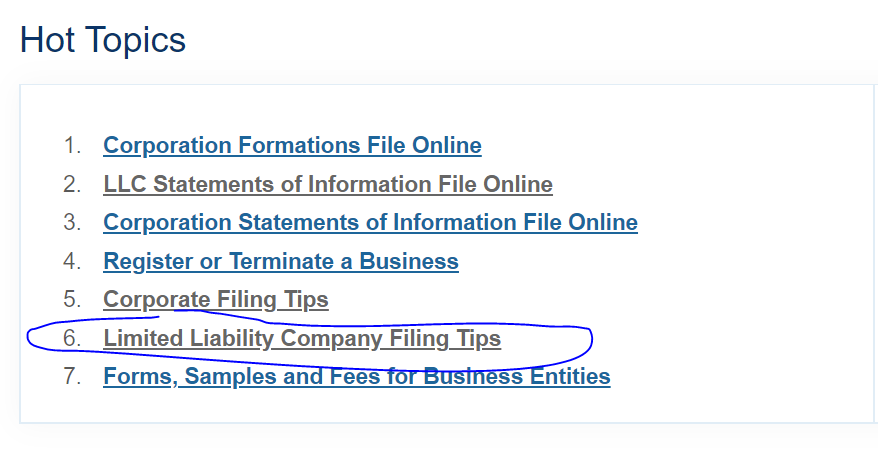

On the business area, at least as of right now, there’s a “Hot Topics” section. Two of them discuss LLCs. The second one gave advice on how to register with the state of California.

In this case, you’ll need to send in signed physical papers to Sacramento. Or if you happen to be visiting Sacramento you can drop them off in person (and still pay a handling fee…). Though being a North Stater myself, I can think of very few reasons why you would happen to be visiting Sacramento.

Do I Need a Lawyer For This?

When searching for LLC advice, there’s plenty of websites that will help you get your LLC set up…for a price. This will often include lawyers or other legal companies. While I suppose it’s possible that some states might make things more complicated, my experience is that you can set this up by yourself without much difficulty.

If someone is trying to do it for you, they’re almost always just trying to make a quick buck.

Do I need Partners?

The great thing about an LLC is that the organization is flexible. Meaning you can have one all by yourself. This process even gets a special name in the Federal tax world, called Single Member Limited Liability Company, or SMLLC.

You can also set up an LLC with partners. The basic process wouldn’t change, but in this case you probably should talk to a lawyer about getting a partnership agreement. Or maybe turn the LLC into an S Corp for reasons that are outside the scope of this post.

Get an EIN

Now that you have set up an LLC with your state, you can get an EIN.

An EIN, or an Employer Identification Number, is like a Social Security Number for your business. Like the SSN, it is a unique identifier, and it’s also probably not something you want to hand out to anyone. If others DO get your EIN, though, it’s not the identity crisis that someone getting your SSN can be.

Getting an EIN only takes about 5 minutes, and can be done at the IRS’s website. Just make sure to save the documentation the IRS gives you, since if you lose it, they won’t give it out again.

Let’s Talk Cost

Since your LLC is creating another legal person, the process isn’t going to be free. The actual cost, though, depends on your state.

For example, Colorado charges $150 for your original filing then $10 a year after that.

California charges you…

*checks notes again*

…$800 a year tax, plus an additional annual fee starting at $900 if you make over $250,000 a year. Though your first year tax is now free!

So…yeah, there’s a lot of variety.

And, unfortunately, no, you cannot just create your LLC in Colorado if you live in California. CA does not like that. Cross state filings can be complicated, but for the vast majority of people, you’re required to set up in the state where you are doing the work.

Fortunately, setting up the EIN is free! Even if you live in California.

How Is This Taxed?

Since I’m a tax accountant, this is where I think things get good: the tax consequences.

But since this is about setting up an LLC, I’ll keep it simple.

If you are a Single Member LLC (see that “Do I Need Partners” section above) and don’t take any additional tax steps, you’ll just add a Schedule C to your normal 1040. You’ll then pay your income tax and your self employment tax (more on that another time, but *spoiler* you have to pay 15.3% tax on everything you make BEFORE income taxes) right on your normal annual tax return.

If you take an extra step, you can turn your LLC into an S Corp and file a separate 1120S. Which has pros and cons.

If you have a partner, you can treat it like a partnership and file a 1065 instead.

And, yes, you can even treat it like a C Corp.

Those options are all great to look into if you want to get fancy, but for people starting up or doing a side hustle, you’re most likely going to want to take the easy route and file the Schedule C.

Final Thoughts

Like I mentioned above, you don’t NEED an LLC. But if you’re planning to make your side hustle more than just doing Uber and Lyft, it really makes sense to get this set up.

If you live in a low fee place like Colorado, it’s pretty much a no brainer.

If you live in California or another state that has high LLC fees, you’ll want to compare the legal benefits against the cost.

When you’re a step beyond the side hustle, though, you absolutely have to have a business entity set up. And the LLC is almost always the best, easiest, and cheapest way to go. Even if you live in California.

Image by Dean Moriarty from Pixabay